The Florida Hurricane Catastrophe Fund, a crucial reinsurance program, will have an estimated $6.72 billion in cash to pay claims during the 2025 storm season, according to a report approved Monday by a panel that helps oversee the program.

The so-called Cat Fund also would have access to about $3.25 billion in borrowed money through what are known as “pre-event” bonds.

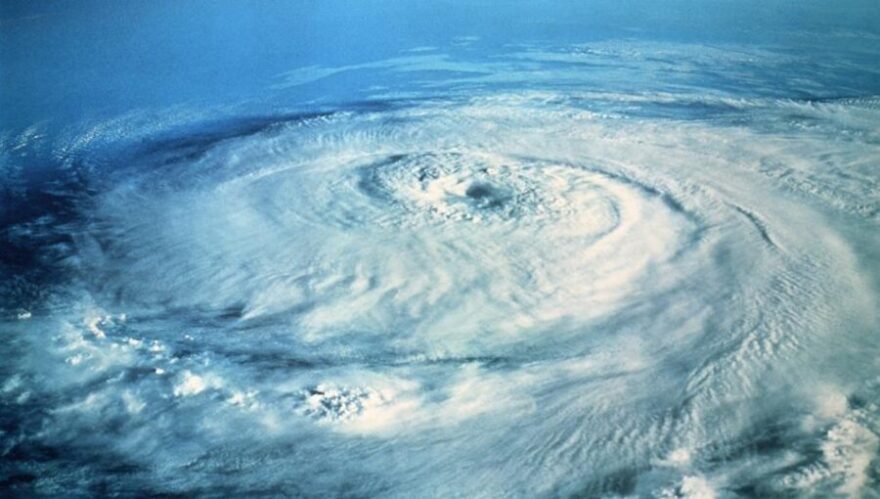

The Cat Fund provides relatively low-cost reinsurance — essentially backup coverage — to insurers to help pay claims if the state gets hit by a major hurricane or multiple hurricanes.

Insurers have to cover pre-determined amounts, similar to deductibles, before they can tap the Cat Fund to help pay claims.

Insurers also buy private reinsurance to pay claims.

Under state law, the Cat Fund is authorized to cover up to $17 billion in losses. In addition to using cash and the pre-event bonds, the Cat Fund has authority to issue additional bonds if it has claims up to that $17 billion total.

The report presented to the Florida Hurricane Catastrophe Fund Advisory Council estimated that the program’s losses from last year’s Hurricane Milton will total about $3 billion.

Its losses from Hurricane Helene, however, will be only $10 million, and it will not have losses from Hurricane Debby, the report said.

By contrast, its losses from 2022’s Hurricane Ian are estimated at $8.5 billion.

This year’s six-month hurricane season will start June 1.